Historical Overview

ThinkMarkets is a multi-asset broker, founded in 2010. It provides online trading services to clients around the world, offering different asset classes such as forex, commodities and stock indices. Over the past decade, ThinkMarkets has grown to become one of the most trusted and respected brokers in the industry. The firm is regulated by the Financial Conduct Authority (FCA) in the UK, as well as other regulatory bodies around the world. This ensures that customers are protected and their money is secure when they trade with ThinkMarkets. The firm also offers competitive spreads and commissions on all its products, making it an attractive option for traders looking for value.ThinkMarkets has won numerous awards over the years for its services, including ‘Best Forex Broker’ at both the 2020 and 2021 Online Personal Wealth Awards. Its commitment to providing excellent customer service and a secure trading environment have helped it become one of the leading brokers in the industry.You May Also Like: Fineco Bank Review 2023: Pros & Cons, Features, App & Accounts

The firm is regulated by the Financial Conduct Authority (FCA) in the UK, as well as other regulatory bodies around the world. This ensures that customers are protected and their money is secure when they trade with ThinkMarkets. The firm also offers competitive spreads and commissions on all its products, making it an attractive option for traders looking for value.ThinkMarkets has won numerous awards over the years for its services, including ‘Best Forex Broker’ at both the 2020 and 2021 Online Personal Wealth Awards. Its commitment to providing excellent customer service and a secure trading environment have helped it become one of the leading brokers in the industry.You May Also Like: Fineco Bank Review 2023: Pros & Cons, Features, App & AccountsThinkMarkets Pros & Cons

Pros

- Offers a range of trading instruments, including forex, commodities, indices, and cryptocurrencies.

- Provides low spreads and commissions, which can be beneficial for traders looking to minimize trading costs.

- Offers access to multiple trading platforms, including MetaTrader 4 and its own proprietary trading platform.

- Provides access to educational resources, including trading guides and video tutorials.

- Regulated by top-tier authorities, such as the FCA and ASIC.

Cons

- Higher minimum deposit requirements than some other brokers.

- Limited availability of customer support outside of regular trading hours.

- Limited research tools and market analysis compared to some other brokers.

- No social trading options.

- Limited availability of payment methods for deposits and withdrawals.

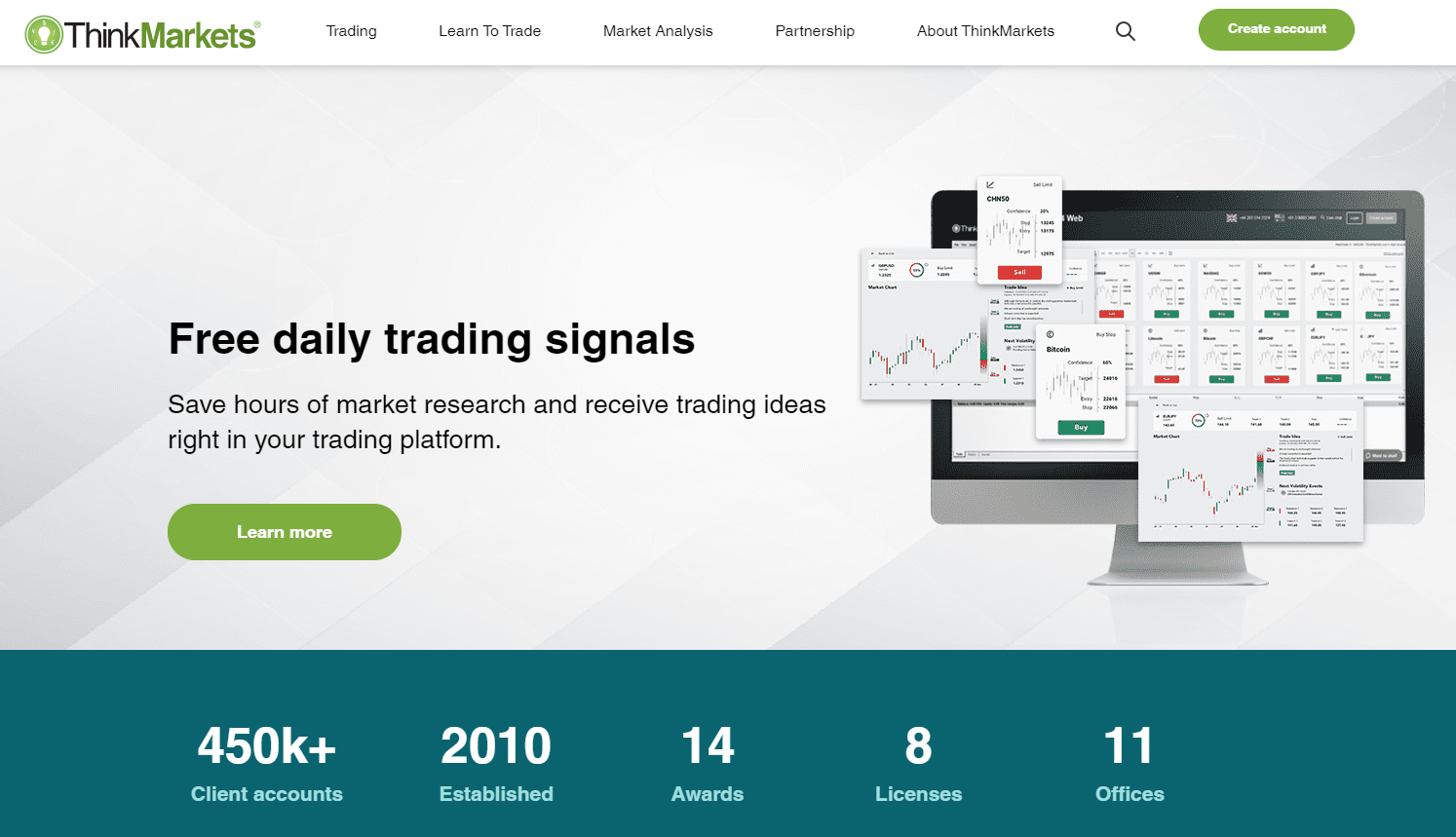

Account Types And Features

Moving on, ThinkMarkets offers a range of account types and features to suit the needs of all traders. From beginners to experienced professionals, they have something for everyone. Here’s a look at what they offer:- Three different accounts – Standard, Pro, and VIP

- Low spreads with competitive pricing

- Access to highly advanced trading tools

For those looking for an easy-to-use platform and features tailored to their needs, ThinkMarkets’ Standard Account might be the perfect fit. It includes access to more than 300 markets with competitive spreads and leverage up to 500:1. The Pro Account is designed for experienced traders who need more advanced features such as low latency execution speeds and higher leverage options up to 1000:1. Finally, the VIP Account is ideal for high volume traders wanting access to premium services such as dedicated account managers and exclusive market insights.No matter which type of trader you are, ThinkMarkets has something for you! With multiple account types, competitive pricing, and a range of advanced features, it’s one of the best brokers around for all your trading needs.Further Reading: Multibank Group Review 2023:A Detailed Look at This Forex Broker

For those looking for an easy-to-use platform and features tailored to their needs, ThinkMarkets’ Standard Account might be the perfect fit. It includes access to more than 300 markets with competitive spreads and leverage up to 500:1. The Pro Account is designed for experienced traders who need more advanced features such as low latency execution speeds and higher leverage options up to 1000:1. Finally, the VIP Account is ideal for high volume traders wanting access to premium services such as dedicated account managers and exclusive market insights.No matter which type of trader you are, ThinkMarkets has something for you! With multiple account types, competitive pricing, and a range of advanced features, it’s one of the best brokers around for all your trading needs.Further Reading: Multibank Group Review 2023:A Detailed Look at This Forex BrokerPlatforms And Tools

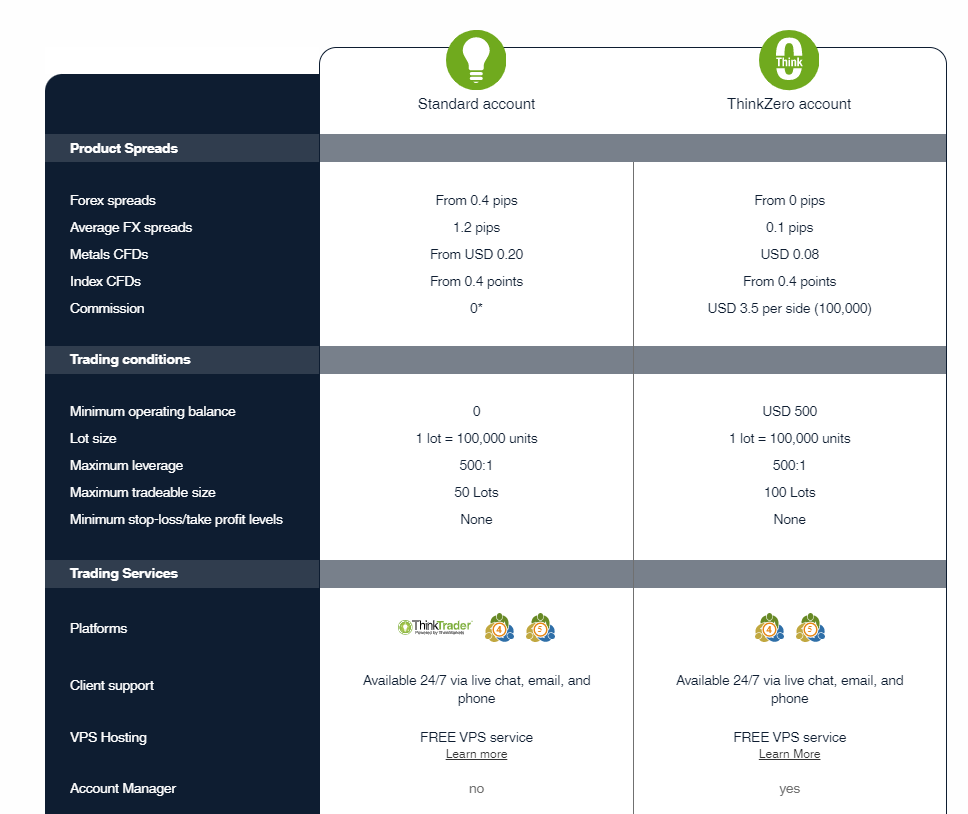

ThinkMarkets provides traders with a wide range of trading platforms and tools to choose from. The main platform is the MetaTrader 4, which is highly praised as one of the most secure and reliable platforms in the market today. It also offers a web-based version, as well as mobile apps for both iPhone and Android devices. All versions come with advanced charting capabilities and a variety of technical analysis tools. The broker also offers its own proprietary trading platform, thinkTrader, which was designed specifically for CFDs, forex and other derivative products. It has an intuitive interface and advanced charting, along with more than 50 indicators and drawing tools. This platform can be used on desktop computers, web browsers, or mobile devices.In addition to all these features, ThinkMarkets provides an array of educational resources including tutorials, webinars and ebooks to help traders become more knowledgeable about different types of investments. There are also customer support services available 24/7 to help answer any questions or concerns you may have while trading on the platform.Explore More: VT Markets Review 2023: A Detailed Look at This Forex Broker

The broker also offers its own proprietary trading platform, thinkTrader, which was designed specifically for CFDs, forex and other derivative products. It has an intuitive interface and advanced charting, along with more than 50 indicators and drawing tools. This platform can be used on desktop computers, web browsers, or mobile devices.In addition to all these features, ThinkMarkets provides an array of educational resources including tutorials, webinars and ebooks to help traders become more knowledgeable about different types of investments. There are also customer support services available 24/7 to help answer any questions or concerns you may have while trading on the platform.Explore More: VT Markets Review 2023: A Detailed Look at This Forex BrokerPricing And Fees

When trading with ThinkMarkets, you will find competitive fees and a variety of pricing plans. All their accounts come with variable spreads, which means that the spread can vary depending on market conditions. You also have the option to upgrade to a commission-based account for even lower fees. In addition, ThinkMarkets offer an Islamic account for those who prefer Sharia-compliant trading.| Instrument | Contract size | Min trade size | Max trade size | Max trade size (ThinkZero) | Min spread (Standard) | Min spread (ThinkZero) | Max leverage |

|---|---|---|---|---|---|---|---|

| EUR/USD | 100 000 | 0.01 | 50 | 100 | 1.1 | 0.0 | 500:1 |

| USD/JPY | 100 000 | 0.01 | 50 | 100 | 1.4 | 0.0 | 500:1 |

| GBP/USD | 100 000 | 0.01 | 50 | 100 | 1.3 | 0.0 | 500:1 |

| USD/CHF | 100 000 | 0.01 | 50 | 100 | 1.5 | 0.0 | 500:1 |

| AUD/CAD | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.0 | 500:1 |

| USD/CAD | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.0 | 500:1 |

| AUD/CHF | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| AUD/JPY | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.0 | 500:1 |

| AUD/NZD | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| AUD/USD | 100 000 | 0.01 | 50 | 100 | 1.1 | 0.0 | 500:1 |

| CAD/CHF | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| CAD/JPY | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| CHF/JPY | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| EUR/AUD | 100 000 | 0.01 | 50 | 100 | 1.1 | 0.0 | 500:1 |

| EUR/CAD | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.0 | 500:1 |

| EUR/CHF | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.0 | 500:1 |

| EUR/GBP | 100 000 | 0.01 | 50 | 100 | 1.1 | 0.0 | 500:1 |

| EUR/JPY | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.0 | 500:1 |

| EUR/NOK | 100 000 | 0.01 | 50 | 100 | 20 | 10 | 500:1 |

| EUR/NZD | 100 000 | 0.01 | 50 | 100 | 1.4 | 0.1 | 500:1 |

| GBP/AUD | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| GBP/CAD | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| GBP/ CHF | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| GBP/JPY | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.0 | 500:1 |

| GBP/NZD | 100 000 | 0.01 | 50 | 100 | 4.2 | 1 | 500:1 |

| NZD/CAD | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| NZD/CHF | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| NZD/JPY | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 500:1 |

| NZD/USD | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.0 | 500:1 |

| USD/NOK | 100 000 | 0.01 | 50 | 100 | 20 | 10 | 50:1 |

| USD/SGD | 100 000 | 0.01 | 50 | 100 | 1.8 | 0.1 | 50:1 |

| USD/MXN | 100 000 | 0.01 | 50 | 100 | 30 | 20 | 25:1 |

| EUR/SEK | 100 000 | 0.01 | 50 | 100 | 20 | 10 | 50:1 |

| EUR/SGD | 100 000 | 0.01 | 50 | 100 | 1.2 | 0.1 | 50:1 |

| USD/SEK | 100 000 | 0.01 | 50 | 100 | 20 | 10 | 50:1 |

| EUR/HUF | 100 000 | 0.01 | 50 | 100 | 8 | 6 | 25:1 |

| GBP/HUF | 100 000 | 0.01 | 50 | 100 | 40 | 6 | 25:1 |

| USD/HUF | 100 000 | 0.01 | 50 | 100 | 6 | 3 | 25:1 |

| USD/CNH | 100 000 | 0.01 | 50 | 100 | 6 | 4 | 20:1 |

| USD/ZAR | 100 000 | 0.01 | 50 | 100 | 40 | 20 | 50:1 |

| USD/TRY | 100 000 | 0.01 | 10 | 10 | 400 | 400 | 10:1 |

| EUR/TRY | 100 000 | 0.01 | 10 | 10 | 900 | 900 | 10:1 |

| EUR/ZAR | 100 000 | 0.01 | 50 | 100 | 40 | 10 | 50:1 |

| GBP/ZAR | 100 000 | 0.01 | 50 | 100 | 40 | 10 | 50:1 |

| EUR/PLN | 100 000 | 0.01 | 50 | 100 | 20 | 10 | 25:1 |

| EUR/CZK | 100 000 | 0.01 | 50 | 100 | 10 | 10 | 20:1 |

Market Instruments

Moving on from pricing and fees, let’s take a look at the market instruments offered by ThinkMarkets. They offer a wide variety of financial products, including Forex currency pairs, CFDs for commodities and indices, as well as shares. Additionally, they provide both vanilla options and binary options trading. All these products can be traded on their proprietary trading platform or one of the MetaTrader platforms. ThinkMarkets provides traders with access to some of the most popular markets in the world. This includes major Forex currency pairs such as EUR/USD, GBP/USD and USD/JPY, as well as minor and exotic currency pairs. In addition to this, they also offer CFDs for indices such as Dow Jones Industrial Average (DJIA), S&P 500 (SPX) and NASDAQ Composite (IXIC). They also provide commodities CFDs for gold (XAU/USD) and silver (XAG/USD). Furthermore, traders can access global stock markets through their share-dealing services.The range of product offerings available allows traders to diversify their portfolio and capitalize on different market conditions. ThinkMarkets also offers a range of advanced charting tools to help traders analyze price movements and identify potential trading opportunities. With its comprehensive range of products and features, ThinkMarkets is well-equipped to meet the needs of both experienced traders and newcomers alike.Check out: Teletrade Review 2023: Is This Forex Broker a Reliable Choice?

ThinkMarkets provides traders with access to some of the most popular markets in the world. This includes major Forex currency pairs such as EUR/USD, GBP/USD and USD/JPY, as well as minor and exotic currency pairs. In addition to this, they also offer CFDs for indices such as Dow Jones Industrial Average (DJIA), S&P 500 (SPX) and NASDAQ Composite (IXIC). They also provide commodities CFDs for gold (XAU/USD) and silver (XAG/USD). Furthermore, traders can access global stock markets through their share-dealing services.The range of product offerings available allows traders to diversify their portfolio and capitalize on different market conditions. ThinkMarkets also offers a range of advanced charting tools to help traders analyze price movements and identify potential trading opportunities. With its comprehensive range of products and features, ThinkMarkets is well-equipped to meet the needs of both experienced traders and newcomers alike.Check out: Teletrade Review 2023: Is This Forex Broker a Reliable Choice?Trading Conditions

At ThinkMarkets, traders can access competitive trading conditions including tight spreads and competitive commissions. The minimum spread for major currency pairs is as low as 0.2 pips with no additional commissions charged. All trades are executed with no requotes, so you’re guaranteed the best possible price. Plus, you won’t get any hidden fees or unfair mark-ups on your trades.ThinkMarkets offers a range of different account types to suit all kinds of traders. From the standard ‘Standard Account’ to the more advanced ‘Pro Account’, there is something for everyone. You can also choose from a variety of base currencies including USD, EUR and GBP, as well as leverage up to 1:500 which makes it easy to manage risk levels.The platform also provides access to over 200 markets including CFDs in Forex, Indices, Commodities and Cryptocurrencies plus a range of automated trading tools like Expert Advisors (EAs). This allows you to automate your trading strategies so you can focus on other aspects of your portfolio while still staying in control of your risk exposure. With ThinkMarkets you have the ability to trade 24/7 and take advantage of global market opportunities at any time of day or night.More Resources: FlowBank Review 2023: What Makes This Forex Broker #1?Education And Research

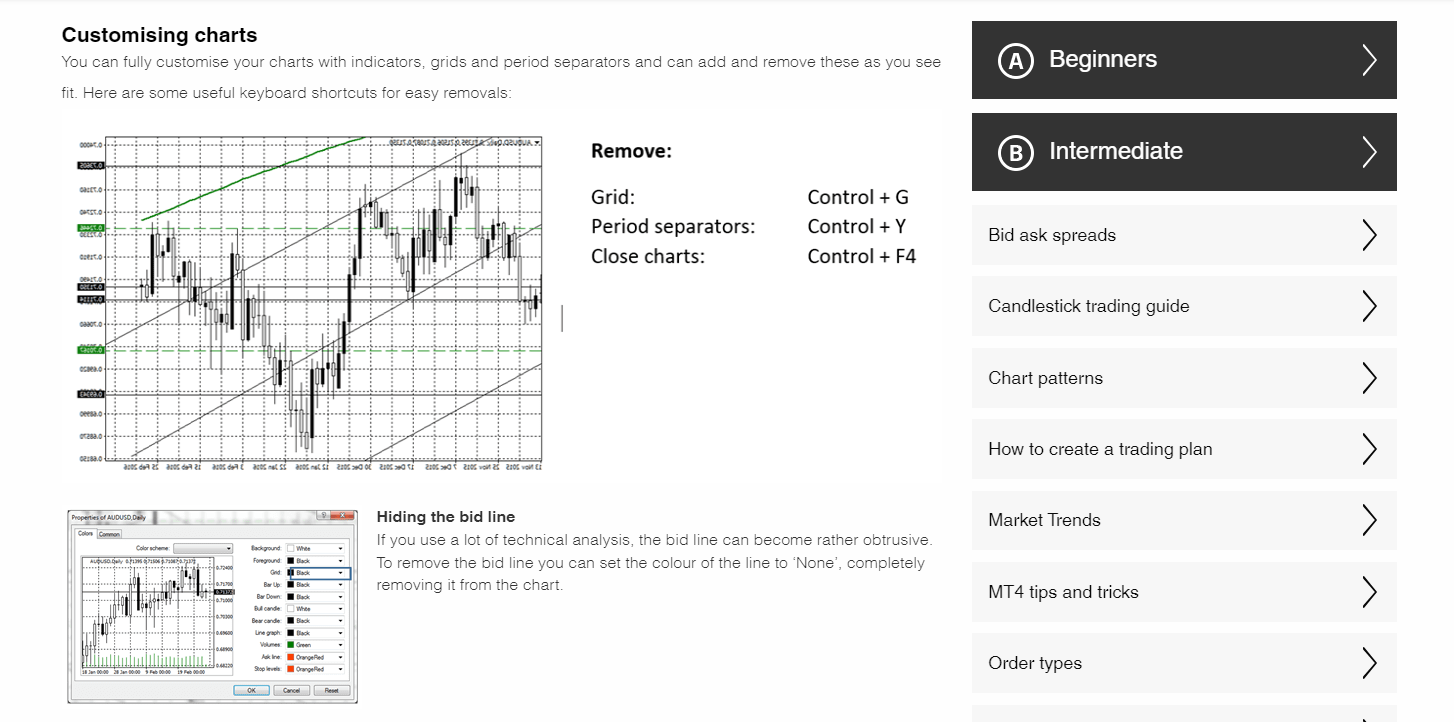

At ThinkMarkets, they offer a wide range of educational resources and research tools to help traders stay ahead of the game. Their Education Center is packed with webinars, e-books, trading guides and tutorials, video lessons, and more. All of these resources are designed to help educate traders and give them an edge over their competitors. They also provide access to market news, analysis reports, and industry updates to keep traders informed about market movements. ThinkMarkets also provides a variety of research tools for both beginners and experienced traders alike. These include charting tools such as Autochartist & Trading Central which can be used for technical analysis and backtesting strategies. In addition, they offer an Economic Calendar that helps keep track of key macroeconomic events that could affect markets. There’s also the Market Sentiment tool which provides insight into how other traders are positioning themselves in the markets.Overall, ThinkMarkets offers a comprehensive set of education resources as well as powerful research tools to help traders make informed decisions when trading in the financial markets. With these resources at their disposal, traders can gain an edge over their competition while still staying up-to-date with what’s going on in the markets.Learn More: Trade Nation Review 2023: Everything You Need to Know

ThinkMarkets also provides a variety of research tools for both beginners and experienced traders alike. These include charting tools such as Autochartist & Trading Central which can be used for technical analysis and backtesting strategies. In addition, they offer an Economic Calendar that helps keep track of key macroeconomic events that could affect markets. There’s also the Market Sentiment tool which provides insight into how other traders are positioning themselves in the markets.Overall, ThinkMarkets offers a comprehensive set of education resources as well as powerful research tools to help traders make informed decisions when trading in the financial markets. With these resources at their disposal, traders can gain an edge over their competition while still staying up-to-date with what’s going on in the markets.Learn More: Trade Nation Review 2023: Everything You Need to KnowCustomer Support

At ThinkMarkets, customer support is top-notch. All the questions and inquiries are answered quickly and efficiently. The customer service team is very helpful and knowledgeable when it comes to trading and investments.The customer service team is available 24/7 via email, phone, or chat for any help you might need with your trading account or investments. You can also access their online library that contains articles and tutorials about trading, market analysis, financial news, technical analysis, and more. ThinkMarkets offers a wide range of services to its customers including educational resources, market research tools and exclusive webinars conducted by experienced traders. They also provide a range of trading platforms such as MetaTrader 4/5, mobile apps for Android and iOS devices, as well as social trading features like Copytrader and Autochartist. With all these features combined, ThinkMarkets provides an excellent experience for all traders looking to make the most out of their investments.Find Out: FXPrimus 2023 Review: Is This Forex Broker Right For You?

ThinkMarkets offers a wide range of services to its customers including educational resources, market research tools and exclusive webinars conducted by experienced traders. They also provide a range of trading platforms such as MetaTrader 4/5, mobile apps for Android and iOS devices, as well as social trading features like Copytrader and Autochartist. With all these features combined, ThinkMarkets provides an excellent experience for all traders looking to make the most out of their investments.Find Out: FXPrimus 2023 Review: Is This Forex Broker Right For You?Regulatory Compliance

ThinkMarkets is a regulated trading broker, regulated by tier-one authorities like the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investment Commission (ASIC) in Australia. They also have regulations from other regulatory bodies like the Cyprus Securities and Exchange Commission (CySEC). This ensures that traders’ funds are protected and that the broker follows strict rules about client funds, transparency, and accountability.The company has a segregated bank account for clients’ funds, so there’s no risk of their money becoming entangled with ThinkMarkets’ own money. The site also has a negative balance protection feature to ensure traders don’t lose more than they have invested. Furthermore, all customer transactions are subjected to Know Your Customer (KYC) compliance procedures to ensure that only legitimate clients can use their services.ThinkMarkets offers an array of trading tools, resources, and educational materials for traders at every level of experience. The company regularly updates its platform with new features and security measures to ensure the highest safety standards for its customers. To sum up, ThinkMarkets provides a secure trading environment backed by stringent regulatory compliance requirements.Dig Deeper: Forex4You 2023 Review: Is This Forex Broker Right For You?Bonuses And Promotions

Thinkmarkets offers a range of bonuses and promotions to attract new traders. Their selection includes welcome bonuses, referral bonuses, and loyalty rewards. Here’s what you need to know before taking advantage of these offers:- Get rewarded for referring your friends – get up to $1000 in cashback when you successfully refer a friend to ThinkMarkets.

- Get a Trade Boost on every trade – increase your potential profits by up to 20% with Trade Boost, available on all trades.

- Take advantage of the 10% Cashback Program – receive cash back on all trading losses up to 10%.

- Enjoy loyalty rewards – earn points for every dollar traded and redeem them for cash or other rewards.

- Benefit from free demo accounts – practice trading risk-free with unlimited virtual funds.

Conclusion

In conclusion, ThinkMarkets is a great option for traders looking to trade in the Forex and CFD markets. It offers multiple account types with competitive spreads and fees, along with plenty of great trading tools and platforms. It also provides an extensive selection of instruments to choose from, as well as educational materials to help you become a better trader. Plus, its customer support team is very responsive and helpful. Finally, ThinkMarkets is compliant with all relevant regulations, so there’s no need to worry about safety or security when trading with them. All in all, ThinkMarkets is an excellent choice for anyone wanting to get involved in the world of online trading.

I’m impressed by the features ThinkMarkets has to offer and I’d definitely recommend it to anyone looking for a reliable broker. They’re transparent about their fees, provide useful research tools and have plenty of bonuses and promotions that make trading even more attractive. Plus, they’ve been around since 2003 which shows they have a long history of providing quality services.

Overall, I’m confident that ThinkMarkets will continue to be a top broker in 2023 and beyond. With their excellent range of products and services at competitive prices combined with strong customer service and regulatory compliance, they’re certainly worth considering if you’re looking for a Forex or CFD broker this year.